CFPB Weakens Deterrence Against Abusive Financial Practices

The Consumer Financial Protection Bureau (CFPB) issued a policy statement late last month that attempts to narrow the scope of federal laws that prohibit abusive financial acts and practices by banks, debt collectors, payday lenders, and other consumer finance companies.

CFA director of Financial Services and Senior Fellow, Professor Christopher Peterson spoke out against the proposal stating that the new policy statement “attempts to rewrite federal law without authorization from Congress or a court order.” It does so by fabricating “a ‘good faith’ exception that lets businesses engaging in abusive practices off the hook for financial penalties when they claim violations of the law were unintentional,” Peterson explained. The policy also imposes a new cost-benefit framework on law enforcement that will slow investigations and create an artificial barrier to protecting the public.

“Every American consumer deserves law enforcement that is creative and flexible enough to protect them from abusive financial practices. Today’s decision will embolden debt collectors, payday lenders, and other finance companies to be more reckless and indifferent to the welfare of their customers,” continued Peterson.

Current federal law, enacted by Congress in the wake of the 2008 financial crisis, prohibits taking unreasonable advantage of consumers who do not have the ability to protect themselves or lack the understanding of the risks in complicated financial contracts.

“[The new CFPB] policy will make it easier for the banking industry to insert tricks and traps in their contracts with the public. Under the Trump Administration, our consumer protection agency is protecting payday lenders, debt collectors, and credit reporting agencies instead of consumers,” concluded Peterson.

Independent Oversight Board Urged to Assess Use of Facial Recognition Tech in Public Spaces

Citing concerns about increasing law enforcement use of facial recognition technology to surveil Americans who are not accused of any crimes, CFA and 39 other consumer, privacy, and civil liberties groups sent a letter to the Privacy and Civil Liberties Board (PCLOB) urging a review of the technology. In their letter, the groups call on the PCLOB to recommend to the President and the Secretary of Homeland Security that they suspend the use of facial recognition systems pending further review and development of privacy guidelines.

In creating the PCLOB, Congress recognized that in conducting the “war on terrorism,” the government may need new powers and to enhance the use of existing powers, and that this shift of power and authority “calls for an enhanced system of checks and balances to protect the precious liberties that are vital to our way of life and to ensure that the Government uses its powers for the purposes for which the powers were given.”

Already, federal and state law enforcement agencies are using a technology that allows them to identify individuals in public spaces who have neither engaged in criminal activity nor demonstrated suspicious activity, according to a recent article in The New York Times.

Adding to the concerns, a recent study from the National Institute of Standards and Technology (NIST) found that false positives are up to 100 times more likely for Asian and African American faces when compared to White faces. The highest rate of false positives were found for African American females, something NIST says is “particularly important because the consequences could include false accusations.”

The PCLOB announced in July of 2019 that, “’Facial Recognition and Other Biometric Technologies in Aviation Security’ is one of the Board’s ‘Active Oversight Projects.’” The groups called on the PCLOB to examine the more significant public concerns about this tech being used in public spaces. The letter added that “the rapid and unregulated deployment of facial recognition poses a direct threat to ‘the precious liberties that are vital to our way of life.’”

“Facial recognition technology is not 100 percent accurate, but even if it was, its use must be balanced with our rights to freedom of movement, freedom of association, and other basic human rights,” said Susan Grant, CFA Director of Consumer Protection and Privacy.

USDA Action on Salmonella, a Good First Step; Tougher Standards Needed

Recently, the U.S. Department of Agriculture’s (USDA) Food Safety and Inspection Service (FSIS) proposed new performance standards for Salmonella in ground beef and beef trim, an overhaul long awaited by consumer advocacy groups. CFA and fellow Safe Food Coalition members Food & Water Watch, the Government Accountability Project, and National Consumers League sent a letter last month applauding the move by FSIS, and urging the agency to go further in light of the increasing virulence and frequency of antibiotic resistance in Salmonella.

In their letter, the group requests that the agency treat raw ground beef contaminated with Salmonella as adulterated, and withhold the USDA mark of inspection from an establishment’s products until the company’s management can show that it has remediated the problem. Such a policy would resemble the way that FSIS currently treats raw ground beef contaminated with E. Coli O157:H7 and other shiga-toxin producing E. coli strains.

Foodborne illness due to Salmonella is a serious problem. Already, Salmonella causes an estimated 1.35 million illnesses, 26,500 hospitalizations, and 420 deaths per year in the United States. The associated medical bills alone can reach or exceed $3.7 billion each year. Based on the latest data from the Interagency Food Safety Analytics Collaboration, 6.4% of these foodborne Salmonella illnesses can be attributed to beef.

Outbreaks of salmonellosis linked to ground beef show no signs of abating. As noted in the proposed standards, just in the last year, two large outbreaks of Salmonella infections linked to ground beef caused over 400 reported cases, over 120 hospitalizations, and at least one death. The establishments implicated in those outbreaks issued recalls of over 10 million pounds of ground beef, much of which had already made its way to consumers. The letter notes that Salmonella outbreaks linked to ground beef pose a serious public health threat in part because of the development of antibiotic resistance in bacteria, which can complicate treatment options and lead to higher rates of hospitalization.

The original performance standards for Salmonella in ground beef were developed in 1996 and only applied to ground beef, not beef trim. The standard set in 1996 requires that fewer than 7.5% of samples test positive for Salmonella. In 2018, only 3.89% of samples tested positive. “While this is a major improvement for consumer safety, allowing nearly 4% of ground beef to carry Salmonella still places consumers at unacceptable risk,” said CFA Director of Food Policy Thomas Gremillion.

The letter also urges FSIS to also share additional data on Salmonella isolates. This information will increase transparency and, as Sen. Kirsten Gillibrand (D-NY) and Rep. Rosa DeLauro (D-CT) pointed out in a letter to USDA Secretary Perdue, “by disclosing [whole-genome sequencing] data, USDA will foster market-based incentives for safer meat and poultry.”

“The experiences of other rich countries, and of our own National School Lunch Program, show that higher standards for Salmonella contamination in raw beef are feasible and cost-effective,” said Gremillion. “The latest performance standards are a step in the right direction, but consumers deserve better.”

CFA Documents Over 100 OHV Recalls in 10 Years

A total of 110 Off-Highway Vehicle recalls occurred between January 1, 2010 and February 3, 2020, for an average of 10 recalls per year, according to the Off-Highway Vehicle recall analysis recently released by CFA. Off-highway vehicles (OHVs) include all-terrain vehicles (ATVs), recreational off-highway vehicles (ROVs), and utility task vehicles (UTVs).

For every recall issued, the Consumer Product Safety Commission (CPSC) estimates the number of impacted vehicles, the reason for the recall, and the number of deaths and injuries if any.

- For the 110 recalls analyzed, the CPSC estimates that 1,474,093 vehicles were sold to consumers and subsequently recalled.

- Among the 110 recalls, fire related hazards accounted for the most recalls (50 recalls, or 45% of the total). Throttle and brake hazards came in second and third with 15 and 11 recalls respectively. Together, these top three hazards represented nearly three-quarters of hazards that led to recalls (69%).

- Injuries and deaths were involved in nearly a quarter of the OHV recalls. Out of the 110 CFA analyzed, 24 recalls involved at least one injury. Tragically, the most serious involved two deaths: one in 2017, in which the OHV rolled over and did not have seatbelts, resulting in the death of a 14 year old, and another in 2016, in which an OHV caught fire and rolled over, resulting in the death of a 15 year old.

“It is imperative that the CPSC investigate why so many recalls are caused by fire risks and work with manufacturers to prevent these risks before these vehicles enter the market,” stated Rachel Weintraub, CFA Legislative Director and General Counsel.

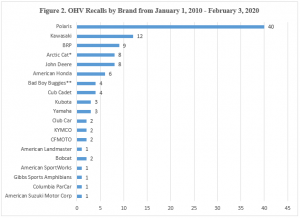

CFA also analyzed the brands of the recalled vehicles. Polaris, with 40 recalls, had the most recalls of the 110 analyzed. That is more than triple that of the brand with the second most recalls. Kawasaki and BRP/Can-Am had the second and third highest number of recalls, with 12 and 9 recalls respectively. The table below shows CFA data on recalls by brand.

In 2019, CFA documented five unilateral recalls issued exclusively by the manufacturer, in this case, Polaris. These “Stop Sale/Stop Ride Notices” were not issued as voluntary corrective actions with the CPSC, and the CPSC did not issue a press release to communicate the action to the public. “We are concerned about these unilateral actions and hope that this will not become a trend,” stated Weintraub. “Enforcement actions should involve the CPSC and should be deemed recalls so that consumers know what they are and find out about them,” she added.

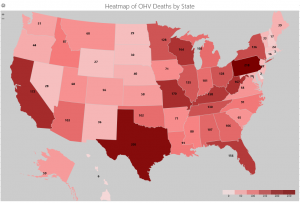

By tracking news reports and analyzing National Highway Traffic Safety Administration (NHTSA) data, CFA also documents OHV related deaths. Between January 1, 2013 and February 3, 2020, CFA and its partners have documented 4,102 deaths involving OHVs. Of these, 720 involved children age 16 or younger (17.55%). Unfortunately, these numbers may continue to rise as we gather more data and as government data is released.

The heatmap below shows OHV deaths across the United States. The darker the color, the more deaths there were in that state.

More information on OHV recalls and deaths can be found on CFA’s website.

Insurance Regulators Urged to End to Geico’s “Patriot Penalty”

Geico, a subsidiary of Berkshire Hathaway, adds a surcharge for the auto insurance premiums of soldiers who dropped their coverage while they were deployed abroad, according to a recently televised investigative report. Through its own research, CFA verified that this “patriot penalty” is real and sent a letter this month to the nation’s insurance commissioners urging them to intervene.

CFA Insurance Expert Douglas Heller stated in the letter that, “it is absolutely outrageous and unacceptable to allow any insurer to charge a higher premium to members of the military solely because they didn’t maintain insurance coverage when they were sent abroad to serve. This penalty for service is revolting and should be barred without delay.”

According to news reports, soldiers returning from active duty can face penalties as high as $500 every six months, even if the service member has a clean driving record. A preliminary review of Geico’s practices indicates that it has a Patriot Penalty in at least 21 states, though further research may provide evidence of the charge in other states as well.

Currently, Arizona, Arkansas, Delaware, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Minnesota, Nebraska, Nevada, New Jersey, New York, North Carolina, Tennessee, Washington, and West Virginia have been identified as states in which Geico charges the fee. Some states, including California and Florida, already explicitly prohibit insurers from imposing this kind of surcharge on safe drivers.

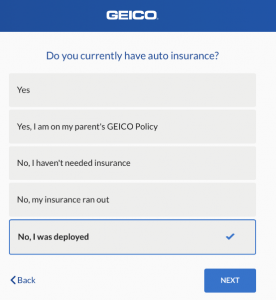

CFA notes that Geico is well aware of the status of these drivers it penalizes, because it specifically asks customers if they had a break in coverage due to deployment (see image below). The practice of charging safe drivers higher rates if they had a lapse in coverage is, itself, an unfair barrier used by many insurance companies that keeps financially stressed drivers uninsured. But the use of this pricing scheme on people who were away from their cars for an extended deployment in service to their nation is uniquely offensive, Heller said.

According to the televised report, Geico refused to answer questions about its Patriot Penalty or defend the practice. That evasion, however, should not be tolerated by state insurance regulators, Heller said.

“Geico talks to the public through its deceptive advertising and refuses to answer reporters’ questions,” said Heller. “But it cannot ignore the Departments of Insurance that approve Geico’s license to do business in each state. Insurance Commissioners and lawmakers need to immediately stand up to Geico on behalf of America’s soldiers,” he concluded.

California Funeral Homes That Hide Prices Charge More

California funeral homes that use a legal loophole to hide prices charge between 31-63% more for services than homes that prominently disclose prices, according to new research released this month by CFA, Funeral Consumers Alliance, and Consumer Action of California.

In general, the report found:

- For basic service fees, the $1,835 median price of “price hiders” was 36% higher than the $1,348 median price of “price posters.”

- For direct cremation, the $1,695 median price of price hiders was 31% higher than the $1,295 median price of price posters.

- For immediate burial without casket, the $2,595 median price of price hiders was 37% higher than the $1,900 median price of price posters.

The report also identified one funeral home company, Dignity Memorial funeral homes, which charged the highest prices of all. Dignity Memorial has 24 locations and is owned by the Service Corporation International. Its basic service fee was 48% higher than the median price of price posters. Its direct cremation price was 31% higher than the median price of price posters. And the price of its immediate burial without casket service was 63% higher than the median price of price posters.

“In our national research, we have not found one Dignity Memorial funeral home that posts prices,” noted CFA Senior Fellow Stephen Brobeck. “And throughout the nation, we have also found that they tend to charge higher prices.”

The research showed not only significant price differences between price disclosers and price hiders, but also a huge range of prices across the six areas studied – City of Sacramento, City of San Francisco, Alameda County, City of Los Angeles, Orange County, and City of San Diego. Prices ranged from $250 to $4,370 for a basic services fee, from $525 to $4,115 for direction cremation, and from $495 to $4,715 for immediate burial without casket.

The research also found numerous examples of non-compliance with California and Federal law. For example, fourteen homes failed to disclose to cremation consumers that they may choose an “alternative container” for direct cremation. Five funeral homes failed to offer customers the option of buying a simple “immediate burial” without ceremony. And five homes provided only package prices without itemized options.

The report emphasizes that prominent price posting by funeral homes is especially important to consumers who are bereaved, face an unexpected death, and/or are required to quickly select a funeral home, because a hospital is urging them to do so.

“These price differences provide additional support for an updated Funeral Rule that would require all funeral homes with websites to conspicuously post their price lists,” noted CFA’s Brobeck.