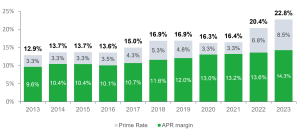

The Consumer Federation of America released the following statement in response to the CFPB report revealing how credit card interest rate margins have reached an all-time high.

“This timely report provides clear evidence to show how credit card companies aren’t just covering their costs – they are applying an additional ‘greedflation charge,’” said Adam Rust, Director of Financial Services for the Consumer Federation of America. “Increasingly, credit card companies play by different economic rules, especially the big credit card issuing banks. This report is another piece of evidence highlighting the effects from a lack of competition. Even though more than three thousand banks issue credit cards, ten banks have more than four–fifths of all accounts – and they charge higher interest rates. It underscores how large marketing budgets permit a few banks to hide higher rates and penalty fees behind rewards promotions. The result is a market that is out of balance.

Today’s report further justifies the CFPB’s work to curb junk fees and promote transparent pricing. In no uncertain terms, it explains why they must level the playing field between consumers and banks and presents one more reason for prudential regulators to increase their scrutiny of merger applications.”