Washington, D.C. — A new Consumer Federation of America (CFA) review of insurance executive compensation shows that CEOs overseeing the nation’s ten largest personal lines insurance companies raked in massive salaries, bonuses, and other payments, while spiking insurance rates are causing hardship for policyholders across the country.

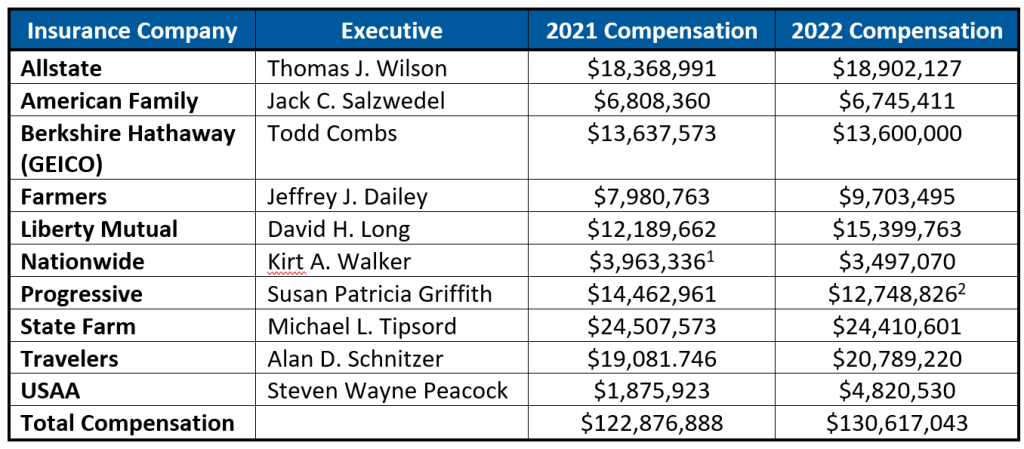

According to August’s Consumer Price Index, auto insurance costs are up 19% compared to 2022. Meanwhile, six of the major insurance company CEOs each received over twelve million dollars in compensation in 2022, and in total, these ten insurance executives were paid over $130 million in 2022. The two-year haul of these ten CEOs amounted to more than a quarter billion dollars ($253,493,931) between 2021 and 2022.

“CEOs are living high on the hog while increasing insurance premiums for people living paycheck to paycheck,” said Michael DeLong, CFA’s Research and Advocacy Associate. “Insurers are telling regulators that ordinary consumers have to pay much more for auto and home insurance because the companies are struggling with inflation and climate change, but they are quietly handing CEOs gigantic bonuses. Drivers are required to buy auto insurance and homeowners have to buy coverage to satisfy their loan requirements, so there needs to be more scrutiny of the rate hikes companies are demanding and the huge CEO paydays that are funded with customer premiums.”

The chart below shows insurance executive compensation paid for both 2021 and 2022. The data come from Nebraska’s Department of Insurance, which requires insurance companies by law to provide information about the salaries, bonuses, and other compensation of their top officials. Since the data reported to the Department may exclude compensation paid to the executives by affiliated companies, it is possible that the compensation figures below underrepresent what the executives actually earned.

These exorbitant compensation packages for insurance executives come as the companies impose punishing charges on their customers and employees. For example:

- While Farmers’ executive Jeff Dailey got a nearly $2 million raise in 2022, his company increased homeowners insurance premiums by over $575 million across 42 states, limited its availability in the company’s home state of California, stopped renewing almost a third of its homeowners insurance policies in Florida, and laid off 11% of its workforce.

- Liberty Mutual paid its CEO David Long over $15 million in 2022—and recently increased its homeowners insurance rates by $729.8 million.

- State Farm paid its CEO Michael Tipsord over $24 million while hiking auto insurance rates in its home state of Illinois four times in a single year, increasing auto rates by 17% in Louisiana, and raising homeowners insurance rates by 28.1% in California while also halting new California applications for homeowners insurance.

[1] 2021 compensation to Kirt Walker is inferred from filings with the California Department of Insurance in which the Nationwide discloses the compensation of its five highest paid executives. The filings (for example, California SERFF# NWPP-133468845) do not name the executives, so the total compensation to the highest paid executive of the Nationwide insurance group is presumed to be Mr. Walker in this table.

[2] The data on Progressive’s 2022 executive compensation come from its 10-K report to the Securities and Exchange Commission, which is available here: https://www.sec.gov/ix?doc=/Archives/edgar/data/80661/000008066123000017/pgr-20230327.htm#i8fa803af503545f28c651644ccb9491b_184.