Washington, D.C. – The price Oregon auto insurance companies charge to a 35-year-old female driver with a safe record is 11.4% higher than is charged for the same coverage to male drivers, according to new research by the Consumer Federation of America (CFA). Using data from 10 of the largest insurers in Oregon representing over 75% of the auto insurance market, CFA also determined that a driver with a poor credit rating will be charged 113% more than the exact same safe driver if that driver had excellent credit.

Using industry data purchased from Quadrant Information Services, LLC that reports the premium charged for a minimum limits auto insurance policy in Oregon, and weighting the data according to market share, CFA found:

- Women will be charged, on average, $976.05 annually for basic coverage, while men will be quoted a premium of $876.20, all other characteristics being equal – a $100, or 11.4%, gender penalty;

- Drivers with a Fair credit rating will be charged $311.45 more than Excellent credit drivers, a 52% credit penalty; and

- Drivers with a Poor credit rating will be charged $674.38 more for basic coverage than Excellent credit drivers, a 112.9% penalty.

Citing this data, and recent Consumer Reports research highlighting the surcharges some insurers impose on blue collar workers and those without college degrees, CFA calls on the Oregon legislature to pass auto insurance reform legislation – HB 2043 – sponsored by Insurance Commissioner Andrew Stolfi, who is also the Director of the Department of Consumer and Business Services. The proposal would prohibit insurance companies from using gender, credit score, education level, job title, marital status, homeownership status, and certain other non-driving factors when setting premiums. Instead, the bill requires that insurers prioritize factors including driving safety record, miles driven, and driving experience when determining a customer’s premium.

“This bill would make the Oregon auto insurance market much fairer than it is today,” said Doug Heller, CFA’s insurance expert. “The bill would also reduce the marketplace disparities that leave Black, Brown, and Indigenous Oregonians currently paying more for the same coverage because insurers are allowed to charge higher rates based on socio-economic status even when customers have perfect driving records.”

The Oregon House Committee on Business and Labor will consider this legislation today at 3:15 p.m. PT.

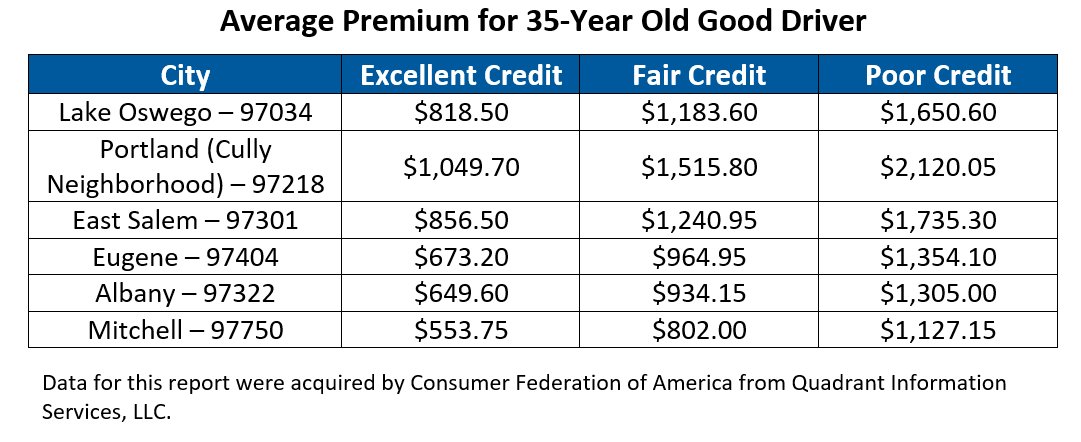

Credit scoring punishes drivers with clean records and increases premiums throughout the state. The table below shows the credit-based premium differences in several communities across Oregon, demonstrating that the credit penalty is imposed on safe drivers no matter where they live.

The data demonstrate that auto insurance premiums vary widely by zip code, but across the state consumers with worse credit are charged substantially higher premiums. Because of systemic biases and long-standing structural impediments to financial services and credit, Black, Brown, and Indigenous drivers have lower credit scores, on average, and bear the worst of credit scoring use by insurers.

Because the credit penalty is often higher than the penalties associated with reckless driving or DUI convictions, lower-credit good drivers are forced to subsidize the premiums charged to excellent credit drivers with a blemished driving record. According to a 2015 Consumer Reports study, Oregon drivers with clean records and poor credit pay $525 more on average for auto insurance than drivers with excellent credit along with a drunk driving conviction.

“Given that Oregon law requires that every driver buy auto insurance, it is deeply unfair that someone with a perfect driving record would pay a higher premium for the same coverage as a more dangerous driver, just because they have a lower credit score,” said Michael DeLong, CFA’s Research and Advocacy Associate. “Many people have lower credit scores because they have struggled financially in the wake of high medical bills, periods of unemployment, unavoidable expenses, and divorce, while many others have lower scores due to errors on their credit report. None of these should lead to higher auto insurance premiums.”

“For too many consumers, auto insurance is expensive to the point that they struggle to afford it,” said Heller. “Because state law requires every driver to purchase this private sector product, lawmakers have a special obligation to make sure the market is fair. When we eliminate these socio-economic barriers to coverage, the number of uninsured motorists in Oregon will also decline, and that will lower rates for everyone.”

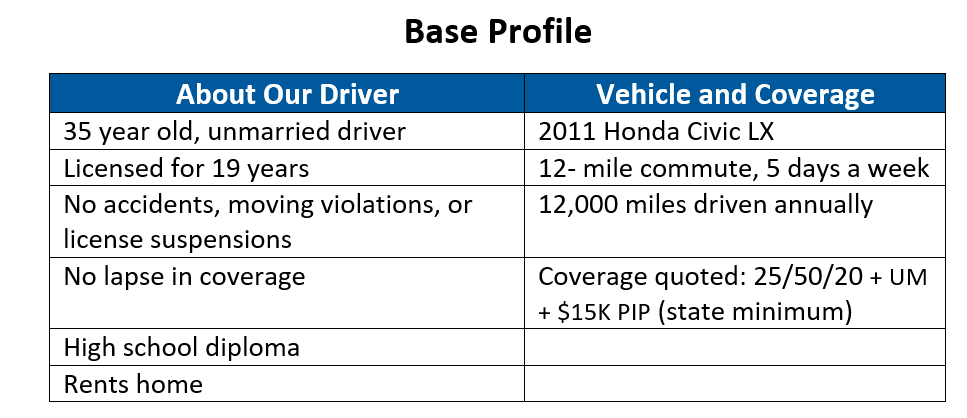

Appendix: Driver Profile for Auto Insurance Premium Data Analysis

Data for this report were acquired by Consumer Federation of America from Quadrant Information Services, LLC. The data are representative of publicly sourced data using the variables and base profile defined below and individual rates may differ.

Contacts:

Doug Heller, 310-480-4170

Michael DeLong, 925-708-1135