Washington, D.C. – Auto insurance rates have risen at a significantly slower pace in states that actively regulate auto insurance prices than those with less vigorous oversight processes, according to an analysis of nearly 30 years of data released today by the Consumer Federation of America (CFA). The data also show that California, which has the strongest rules in the country, has maintained the slowest pace of growth of any state while also fostering the second most competitive auto insurance market in the nation.

The study, Auto Insurance Regulation – What Works 2019, found,

- Since 1989, consumer spending on auto insurance rose by 61.1% nationally, but it grew by only 12.5 % in California, which was the lowest in the nation.

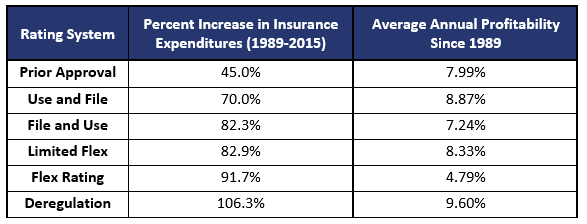

- States using a “prior approval” system of regulation saw increases of 45% during the period while deregulated and weakly regulated states saw average increases above 80%.

- The cost of liability insurance – the coverages required by law in most states – increased by 58.5% nationwide, but it decreased by 5.7% in California.

- Because of California’s success holding down rates, drivers in that state have saved $154 billion since 1989.

- The California auto insurance market has become the 2nd most competitive market in the nation.

- California insurer return on net worth from 1989 to 2016 averaged over 10% while national profits were 8%

- Drivers in other states could save $60 billion a year by adopting California’s approach to regulation and consumer protection.

The complete report is available here.

“The data show that drivers save more money when insurance companies face scrutiny and are required to abide by consumer protections standards,” said study co-author J. Robert Hunter, CFA’s Director of Insurance and former Texas Insurance Commissioner. “State laws strongly regulate consumer behavior by requiring that drivers buy insurance, but most states don’t do nearly enough to regulate the practices of the companies selling that insurance.”

Using 2015 data from the National Association of Insurance Commissioners (NAIC), the most recent available as the research was undertaken, CFA calculated the change in both total auto insurance expenditures (the average drivers spend on all coverages) and auto liability premiums (which excludes comprehensive and collision coverage) around the country since 1989. That is the year that California’s 1988 voter approved insurance reform initiative Proposition 103 took effect, marking a critical point of divergence for that state’s market and an opportunity to track the impact of consumer protection laws.

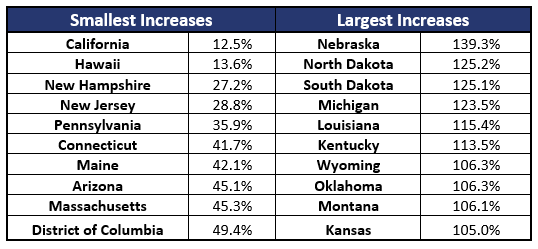

The change in insurance spending between 1989 and 2015 illustrates how some states have seen modest changes, while expenditures have doubled in others:

In addition to looking at the states individually, the report considered how consumers and companies fared under the several different approaches to rate regulation common around the nation. It found that states that use a “prior approval” system, which requires insurance companies to justify their rate changes to state regulators before implementing them, see better consumer outcomes than states with weaker approaches to oversight. Those weaker systems let insurers, to different degrees, raise premiums without waiting for a regulatory review and approval. Notably, company profits were not particularly impacted by the regulatory system in place.

“Every state government except New Hampshire requires that drivers buy insurance, so governments have a special obligation to ensure fair and affordable coverage,” said CFA’s insurance expert and study co-author Doug Heller. “The states that ask insurance companies to demonstrate the appropriateness of rate hikes before imposing them, raise rates the least, without sacrificing industry profitability or market competitiveness.”

CFA also reported that prior approval states were no less competitive than other systems, and when the size of state markets considered, prior approval appears to foster the most competitive markets. The report also highlights the fact that California’s consumer protection regime – often derided by the insurance industry – nurtures the second most competitive auto insurance market in the nation.

California’s Success Shows the Way to Savings for Drivers Across the Country

Comparing California’s relatively small increases in the years since Prop 103’s enactment with what consumers would be spending if the state instead followed the national rate trajectory after 1988 reveals that California drivers have saved $154 billion over the past three decades. According to CFA, that savings is the result of Prop 103’s prior approval system, a series of other consumer protections detailed in the report, and a consumer protection ethic at the state’s Department of Insurance.

“California has the most cars on the road and staggering congestion in some of its cities and suburbs, but drivers pay less for coverage than most of the country and have seen far more moderate increases in insurance costs because of the protections in Prop 103,” said Heller. “Because the voters passed Proposition 103 and most Insurance Commissioners since 1989 have been good stewards of the law, Californians keep an extra $6 billion in their wallets every year.”

Drivers in other states, according to CFA, could see significant savings if lawmakers and regulators would apply the same rigorous oversight and consumer protection laws deployed in California. If states took the California approach to their obligation to ensure a fair and affordable market, CFA calculates that American drivers would see their annual premiums drop by $60 billion annually. States that would save $2 Billion a year or more by adopting these rues include Florida, Georgia, Illinois, Michigan, New York and Texas.

As policymakers and regulators look for ways to ensure the most protection for their own constituents, CFA’s study found that the California experience offers significant support for adopting a strong consumer protection approach to the insurance market. This approach includes,

- a prior approval approach to rate setting;

- incentivizing safe driving and loss reduction by requiring that customer premiums rely primarily on driving-related factors such as driving record and miles driven annually

- enhancing competition by balancing supply and demand; while required to buy auto insurance, good drivers are guaranteed to get auto insurance from the insurer they choose, at the lowest rate that insurer group has for that consumer;

- preventing the pass through to consumers of inefficient company costs, such as bloated executive salaries, fines and penalties, and lobbying expenses;

- support for consumer involvement in the rate setting process; and

- full transparency in the ratemaking process.

“We have been studying America’s auto insurance markets for years, and California has set the standard for savings, fairness, and real competition,” said J. Robert Hunter. “If American drivers want to see significant auto insurance savings, they should demand the kind of consumer protections that California voters gave themselves 30 years ago.”

CFA has published a series of reports on the nation’s auto insurance regulatory systems over the years, which are available here:

Another series of CFA auto insurance studies related to affordability around the country is available here.