SEC Urged to Halt Damaging Expansion of Private Securities Markets

Pro-investor and public interest groups have called on the Securities and Exchange Commission (SEC) to halt any further expansion of private offering exemptions from the securities laws at least until it can conduct a careful analysis of the impact the proliferation and expansion of these exemptions has had on investor protection and the health of our public markets.

CFA filed detailed comments with the agency earlier this month explaining how four decades of deregulatory actions by Congress and the SEC have seriously eroded the health of public securities markets that are essential to the health of our economy. The result is that there are fewer public companies today than there were in the 1970s, far fewer initial public offerings (IPOs) than would be expected based on historical norms, and significantly more money raised through private offerings today than is raised in public markets.

“Whether you measure by the number of IPOs or the number or percentage of U.S. companies that are listed on a major securities exchange, the downward trend is inescapable,” said CFA Director of Investor Protection Barbara Roper. “Our public markets, once the envy of the world, are in decline. That has enormous implications both for the health of our economy and for the protection of investors.”

The comments were filed in response to an SEC concept release that, in the name of harmonizing securities offering exemptions, proposes to further expand the ability of companies to raise capital through private offerings and to market those private securities to retail investors. “Instead of seeking to address the urgent threat to our public markets, the SEC is considering proposal that would make the problem far worse,” Roper said. “In essence, they appear intent on recreating the conditions that led to the stock market crash of 1929 and the ensuing Great Depression.”

Expanding private markets also puts investors at increased risk of harm. Not only do they not receive basic information needed to make an informed investment, they also operate without the same protections that exist in the public market to ensure that they operate on an even playing field with large, institutional investors. “In public markets, all investors are promised equal access to high-quality information about the companies that they may choose to invest in, but in private markets, certain investors can receive preferential access to information and terms,” said CFA Financial Services Counsel Micah Hauptman. “This means that in practice, insiders such as venture capital (VC) funds get first dibs on the best deals while retail investors get the leftovers of what other investors don’t want,” Hauptman continued.

In September, the House Subcommittee on Investor Protection, Entrepreneurship, and Capital Markets held a landmark hearing “Examining Private Market Exemptions as a Barrier to IPOs and Retail Investment.” In a statement submitted for the record, CFA praised the committee for holding a hearing to address this important topic and urged members to “follow up with action to restore a healthy balance between our public and private markets.”

CPSC Unanimously Votes on a Proposed Standard to Remove Dangerous Sleep Products from the Market

The U.S. Consumer Product Safety Commission (CPSC) recently proposed a strong new standard for infant sleep products and consumer advocates are praising the move. The proposal, which was voted on this week and received unanimous support, addresses the many dangerous inclined sleep products on the market, such as the recently recalled Fisher-Pride Rock ‘n Play. Consumer advocates from CFA, The American Academy of Pediatrics (AAP), Kids in Danger (KID), Public Citizen, and U.S. Public Interest Research Group Education Fund (U.S. PIRG) praised the proposal for providing an opportunity to remove these products from the market and keep them off store shelves.

Inclined infant sleep products have been involved in 73 infant deaths over the past 17 months, including 64 in freestanding framed units, such as the Fisher-Price Rock ‘n Play.

If finalized, the proposal by the CPSC will essentially ban all inclined infant sleep products and prevent new untested products from emerging into the market. It accomplishes this by requiring all infant sleep products to meet safety requirements already used for products like bassinets, including requiring a flat surface, no restraints, and adequate side height to contain an infant.

The unanimous vote by the CPSC is a major step forward in safe sleep and helps to reassure parents that their children won’t be harmed by these, or similar, products. The groups previously submitted a statement on Safe Sleep Principles to the CPSC and ASTM International and call for all products sold for infant sleep to meet those principles.

“We applaud the CPSC for voting to move forward of this lifesaving rule,” stated Rachel Weintraub, legislative Director and General Counsel, Consumer Federation of America. “We urge the CPSC to immediately recall of all inclined sleep products on the market.”

Consumer Advocates Press Congress to Let FDA Determine the Safety of CBD Products

In a September letter to members of the Senate, CFA and Center for Science in the Public Interest (CSPI) highlighted the need for more rigorous research into Cannabidiol (CBD) and urged Congress to allow the Food and Drug Administration (FDA) to regulate the product without being rushed in its decision-making process.

The letter comes in response to proposed legislative language introduced in the Senate by Majority Leader Mitch McConnell (R-KY) that would direct the FDA to exercise “enforcement discretion” with respect to CBD products. Consumer advocates were quick to point out that much is still unknown about the risks and safety of CBD and other cannabinoids, and that high potency CBD products, including products marketed for children, are currently available for sale. These products have also been found to contain other cannabinoids, including psychoactive ones such as Tetrahydrocannabinol (also known as THC, the main active substance in recreational cannabis).

The letter highlighted three areas of concern with the potential pathway for CBD legalization in foods and supplements proposed by Majority Leader McConnell:

- The FDA currently lacks needed authority and resources to effectively address the myriad problems that may arise from CBD use in supplements.

- For food substances, companies may self-determine that a substance is generally recognized as safe (GRAS) and use it in food without telling the FDA. Given this loophole, FDA may never review the safety of many CBD uses in food.

- Finally, dietary supplement manufacturers can first declare CBD is GRAS for food in secret, thereby evading the FDA’s “new dietary ingredient” (NDI) safety review for supplements and, in doing so, also exploit an exemption that applies to “food ingredients.” An estimated 75-80 percent of new ingredients in supplements evade FDA safety reviews in just this way.

In order to fix these issues, consumer advocates proposed three ways to provide an avenue for CBD to safely enter the consumer market:

- As it did with trans fats, FDA should be asked to report on whether it can and should issue a tentative determination that CBD is not GRAS. Such a tentative determination would immediately make clear that FDA is asserting its role in oversight of the food safety system. The process would also allow FDA to issue approvals for specific uses, including quality standards, to ensure that food companies making these products do so in a safe, transparent way.

- Congress should provide more authority for FDA to ensure the safety of supplements containing CBD, and in general. By requiring mandatory product listing, providing a stronger safety requirement and clearer authority to recall dangerous products, closing the GRAS loophole, and creating specific prohibitions on highly concentrated products, Congress can create this necessary authority over supplements.

- An interim enforcement discretion policy is urgent and warranted, but FDA should not be rushed. The FDA needs time to publically articulate its enforcement priorities and review the necessary scientific data in order to avoid public health risks created by rushing a decision.

“Despite the hype, lots of questions about the safety and efficacy of CBD remain unanswered,” said Thomas Gremillion, Director of Food Policy at CFA. “Congress should not rush FDA to rubber stamp CBD products, but rather give the agency the resources and authority it needs to protect consumers.”

Overturning FCC’s Fraudulent Accounting Rules Could Save Consumers Over $70 billion Per Year in Overcharges

Three years after CFA published a major analysis showing that consumers are being overcharged over $70 billion a year for broadband, wireless, and television services, the Irregulators filed a reply brief in response to the Federal Communication Commission’s (FCC) decision to continue its fraudulent accounting rules for another six years.

The Irregulators, a group of independent, expert analysts, auditors, lawyers, and consumer advocates including CFA, have been working on communications policy since 1999. The groups identified two major outcomes they hope to achieve by overturning what they call “the FCC’s fraudulent accounting rules”:

- “If we win, the FCC will have to fix the rules to stop the cross-subsidies, including wireless – saving billions of dollars per state that can be used for building out the state infrastructure, and lowering rates on most services.

- And if we win, where it is decided that the FCC rules are no longer required (as the FCC insists), then the FCC loses control over the infrastructure, and the states can go after the billions in cross-subsidies we identified.

Conversely, if the Irregulators’ challenge fails, they stated, “the status quo gets worse due to a hyper-growth of cross-subsidies, based on questionable 5G deployments, no competition, continuous higher prices, made up fees and government subsidies given to companies that failed to previously deliver on broadband commitments. And there will be no oversight by a corporate-industry captured government agency that has stopped working for the public’s best interests.”

Mark Cooper, a member of the Irregulators and CFA Director of Research, stated “CFA applauds the court case, and looks forward to participating in the new rulemakings that will force the FCC and state commissions to adopt a more realistic, pro-competitive and pro-consumer allocation of costs.”

“The initial and reply briefs of the Irregulators demonstrate, beyond a shadow of a doubt, that the case against the extension of the massive misallocation of cost to the local phone service is compelling. The FCC’s effort to avoid its responsibility to look at real world costs, fails on legal and empirical grounds,” continued Cooper.

“The filing of the Irregulators’ reply brief, which we are certain will compel this case to a favorable conclusion for consumers, is the beginning, not the end of the process. The remedy sought, vacating or remanding the rules, will compel the FCC to consider the current reality of the communications sector, and push the states to reassert jurisdiction over the local communications network – both its cost and its use,” concluded Cooper.

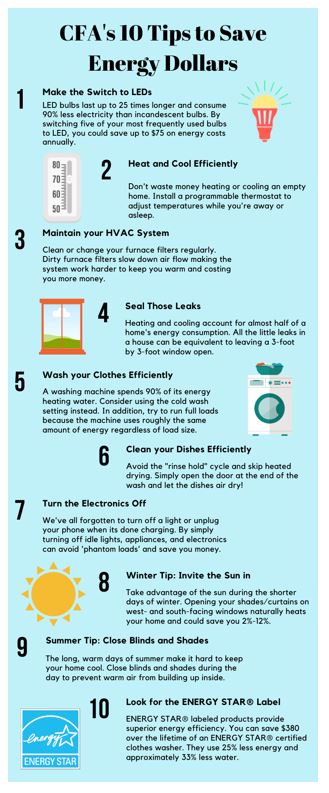

CFA’s 10 New Ways to Save Energy and Money

With winter just around the corner, now is a good time to check out CFA’s 10 Ways to Save Energy and Money, which CFA released earlier this month on the 4th annual Energy Efficiency Day.

“CFA has been promoting energy efficient policies and practices for decades”, said Mel Hall-Crawford, CFA Director of Energy Programs. “Energy costs take a huge bite out of household budgets, with the typical household spending, on average, $2,000 each year on home energy bills. Today is an opportunity to highlight some ways consumers can put some of that money back into their pockets. It can start with something as simple as changing to an LED light bulb or closing your window blinds. But the more steps you take as often as you can, the bigger savings!”