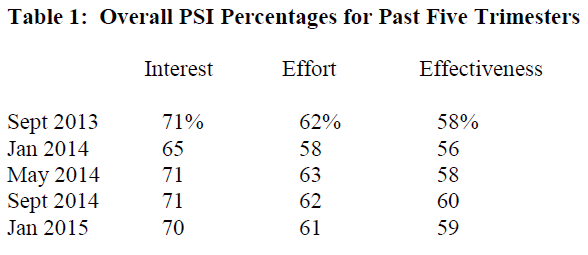

Washington, D.C. – The interest, effort, and effectiveness of Americans to save personally was much higher this month than a year ago, according to data collected earlier this month by American Saves for its triannual Personal Savings Index (PSI). In January 2014, savings interest was at 65 percent, savings effort at 58 percent, and savings effectiveness at 56 percent. In January 2015, interest was at 70 percent, effort at 61 percent, and effectiveness at 59 percent. These latter percentages were only marginally lower than those for savings data collected in both September 2013 and September 2014 (see Table 1).

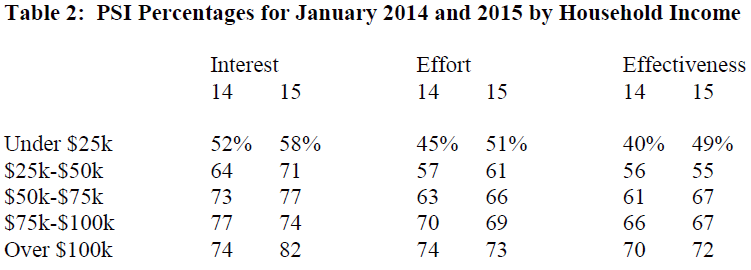

“Last year at this time, we suggested that a post-holiday financial hangover helped explain the decline in savings interest, effort, and effectiveness from September 2013 to January 2014,” said Stephen Brobeck, Consumer Federation of America Executive Director and a founder of America Saves. “But the fact that the decline did not occur between September 2014 and January 2015 suggests that Americans are now feeling better about their financial condition,” he added. Data collected by ORC International for America Saves in five triannual surveys shows a strong positive association between PSI percentages and household income.

Comparing survey data over the past year also suggests that substantial increases in the savings interest, effort, and effectiveness of low- and middle-income households account for almost all of the overall PSI increases (see Table 2). Significant increases occurred for those with less than $75,000 annual income, but little or no increases for those with income above this amount.

“Our new data suggest that low- and middle-class Americans are feeling more optimistic about their financial situation now than a year ago,” Brobeck noted. “Instead of being distracted by heavy holiday spending and debts, they are nearly as interested and active saving today as they were this past September,” he added.

The most recent survey was undertaken for America Saves by ORC International, which surveyed a representative sample of adult Americans (by cell phone and landline) January 8-11, 2015. Respondents were asked, after learning that the survey dealt with “personal saving for goals ranging from s rainy day fund to retirement,” to rate their personal savings interest, effort, and effectiveness on a ten-point scale. The survey has a margin of error of plus or minus three percentage points.

The PSI surveys have been undertaken by America Saves as part of its larger campaign to encourage and assist saving, especially by low- and moderate-income households. Over the past decade, dozens of local Saves campaigns as well as national efforts have persuaded nearly 400,000 Americans to take a savings pledge that requires specification of a savings goal, monthly dollar amount, and savings time period. America Saves also organizes the annual Military Saves Week and, with the American Savings Education Council, the annual America Saves Week, held the last week of every February for the past eight years.

Contacts: Katie Bryan, 202-939-1018; Jack Gillis, 202-737-0766

America Saves, a campaign managed by the nonprofit Consumer Federation of America, seeks to motivate, encourage, and support low- to moderate-income households to save money, reduce debt, and build wealth. The research-based campaign uses the principles of behavioral economics and social marketing to change behavior. Non‐profit, government, and corporate groups participate in America Saves nationally and through local, regional, and statewide campaigns around the country. America Saves encourages individuals and families to take the America Saves pledge and organizations to promote savings year-round and during America Saves Week. Learn more at americasaves.org and americasavesweek.org.